Insights into the physical world anchored in location analytics

Article

Article

Placer.ai March 2025 Office Index: Back to RecoveryThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 10, 2025

3 minutes

INSIDER

Report

3 Consumer Trends to Watch in 2025Dive into the data to explore key trends shaping consumer behavior in 2025 and discover strategies helping top brands drive foot traffic to brick-and-mortar stores.

March 27, 2025

6 minutes

Article

Article

Placer.ai March 2025 Mall Index: Visits Rebound The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 8, 2025

4 minutes

Article

Article

Meal Prep Madness: Wild Fork Foods and Clean EatzThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 7, 2025

4 minutes

Industry Trends

Year-Over-Year Visits to Grocery Stores by State

Article

Article

Q1 2025 Quick-Service and Fast-Casual RecapThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 9, 2025

4 minutes

Article

Article

Placer.ai March 2025 Office Index: Back to RecoveryThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 10, 2025

3 minutes

Article

Article

Q1 2025 Quick-Service and Fast-Casual RecapThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 9, 2025

4 minutes

Article

.png)

Article

Placer.ai March 2025 Mall Index: Visits Rebound The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 8, 2025

4 minutes

Article

Article

Meal Prep Madness: Wild Fork Foods and Clean EatzThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Apr 7, 2025

4 minutes

Latest

Article

Dave & Buster’s Ups Its GameEatertainment concepts have grown in popularity as consumers continue to prioritize experiences. We dove into the latest location intelligence for one of the leaders in the space – Dave & Buster’s – to explore the consumer behavior and demographics behind its foot traffic growth.

April 4, 2025

3 minutes

Article

Coffee Visits: Perks in The Segment Coffee reigns supreme in the United States, fueling a robust coffee shop sector that continues to thrive despite economic headwinds. We took a closer look at industry-wide trends to understand how the segment is performing.

April 3, 2025

4 minutes

Article

The Dining Habits of College StudentsWith spring break upon us, we dove into the data to see how today’s college crowd allocates its dining dollars. Where do they like to eat out? And how can brands best cater to their preferences?

April 2, 2025

4 minutes

Article

Old Navy's Foray Into OccasionwearHow has Old Navy's introduction of occasionwear impacted visits to its stores, and what can these impacts tell us about the brands' consumer base?

April 1, 2025

1 minute

Article

JonasCon Brings Even More Experiential to American Dream American Dream hosted the first ever JonasCon on March 23rd, 2025. How did the event impact visitation trends, and what does the success of JonasCon mean for the future of malls? We dove into the data to find out.

April 1, 2025

4 minutes

Article

What Happened to Family Dollar? Dollar Tree's recently announced plan to sell Family Dollar at a significant loss is another sign of the recent struggles in the discount and dollar store sector. We dove into the data to understand what is driving Dollar Tree’s decision and what this means for Family Dollar moving forward.

March 31, 2025

5 minutes

Executive Insights

The Impending Transformation of Bev-Alc RetailFive years after the pandemic, and deep into a renewed national interest in wellness and sober living, how is the Bev Alc segment faring? We took a deep dive into the space to uncover new trends, changes with consumer engagement, and potential headwinds for the industry.

March 28, 2025

5 minutes

Article

The Changing Apparel Landscape in 2025The apparel space has faced considerable headwinds in recent years – from changing consumer preferences to cutbacks in discretionary spending. We dove into the data for various apparel categories to explore emerging industry trends and see what foot traffic patterns can tell us about the state of ap

March 27, 2025

4 minutes

Article

CVS and Walgreens in 2025CVS and Walgreens, the two largest drugstore chains in the country, have faced increased competition in recent years. To adapt, both chains are optimizing their brick-and-mortar footprints. We took a look at the two chains’ visit performance to see what lies ahead for each.

March 26, 2025

4 minutes

Article

Target’s Bet on Babies Target is building out its baby and toddler assortment - find out what the data says about that decision.

March 25, 2025

1 minute

Article

Trader Joe’s and Aldi’s Continued SuccessIn a period marked by ongoing inflation and rising grocery prices, two chains – Trader Joe’s and Aldi – continue to thrive. We took a closer look at the two chains’ data to see what is driving their continued success.

March 25, 2025

4 minutes

.jpg)

Executive Insights

Retailers Betting on High Income HouseholdsDespite general growth in retail visitation over the past few years, rapid price increases and changes in consumer behavior may finally have caught up to consumers across income levels. Retailers are increasingly targeting high income consumers to offset a drop-off in demand.

March 24, 2025

5 minutes

Retail

Article

Meal Prep Madness: Wild Fork Foods and Clean EatzConsumers are as interested as ever in heath-conscious eating, and many are turning to protein-packed diets to meet their fitness and wellness goals. We took a closer look at two retailers making a name for themselves in the high-protein, health-centric food space – Wild Fork Foods and Clean Eatz.

April 7, 2025

4 minutes

Article

Old Navy's Foray Into OccasionwearHow has Old Navy's introduction of occasionwear impacted visits to its stores, and what can these impacts tell us about the brands' consumer base?

April 1, 2025

1 minute

Article

JonasCon Brings Even More Experiential to American Dream American Dream hosted the first ever JonasCon on March 23rd, 2025. How did the event impact visitation trends, and what does the success of JonasCon mean for the future of malls? We dove into the data to find out.

April 1, 2025

4 minutes

QSR

.webp)

Article

From Nashville to Knoxville: Tennessee’s Migration Growth In recent years, Tennessee has emerged as a surprising migration hotspot. We took a closer look at the data to gain a more thorough understanding of the shifts taking place in the Volunteer State.

January 29, 2025

3 minutes

Article

2024 Retail Foot Traffic RecapWith 2024 firmly in the rearview mirror, we look back on the year’s retail foot traffic trends and what they may signal for 2025. Read on for a closer analysis of the retail categories and states that excelled at driving growth.

January 6, 2025

3 minutes

Article

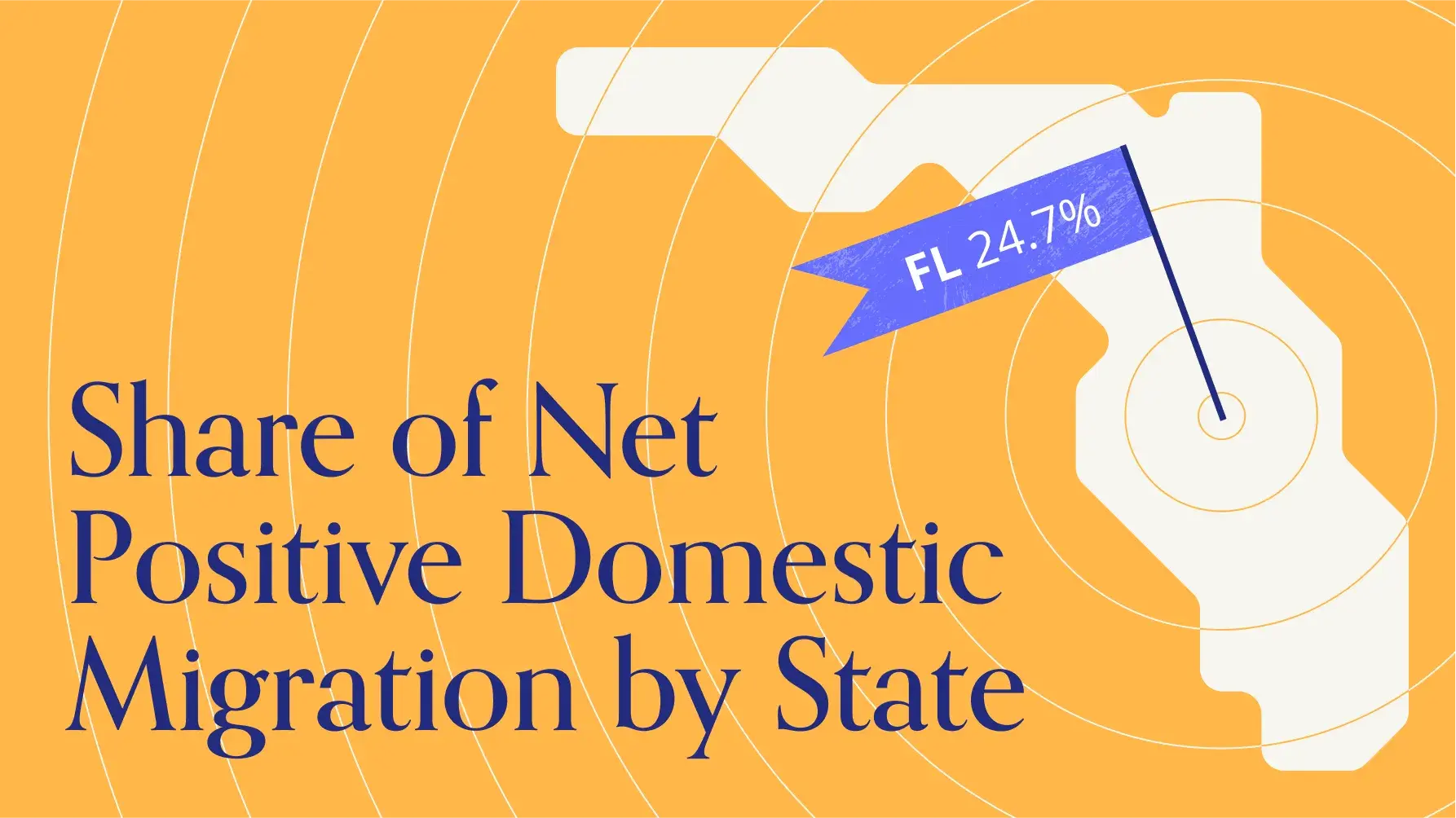

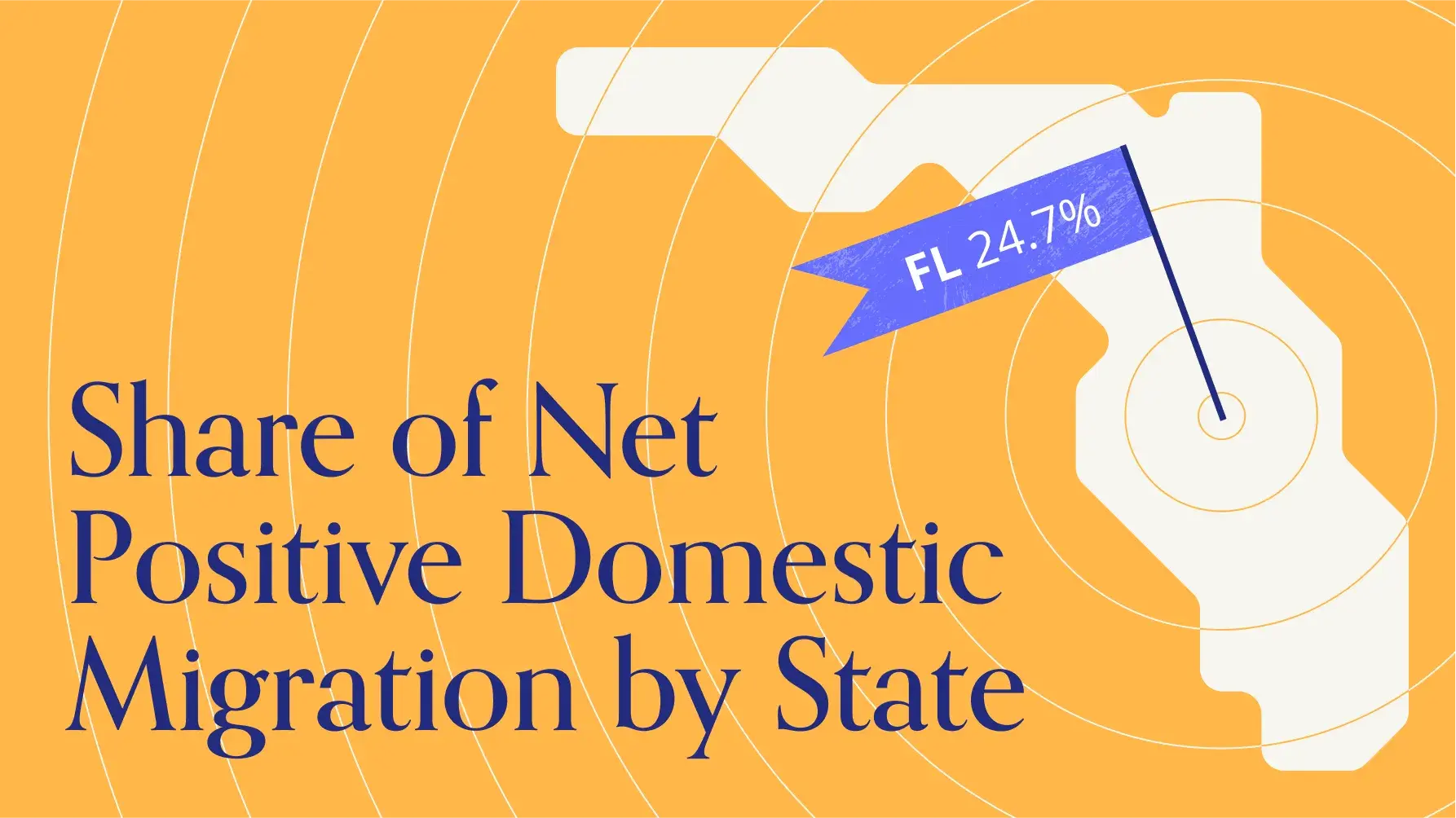

How the Pandemic Reshaped Florida’s PopulationFlorida became a domestic relocation hotspot over the pandemic. Where did newcomers come from, where did they choose to settle, and which areas are attracting the wealthiest new residents? We dive into the data to find out.

January 3, 2025

6 minutes

.webp)

Article

Detroit’s Domestic Migration Resurgence Detroit is making a comeback – and location intelligence data can help explain some of the city’s growth.

December 23, 2024

2 minutes

.png)

.png)

.png)

.png)

.svg)