The holiday season is right around the corner, bringing with it some of the most impactful shopping periods of the year. We took a closer look at visit performance across major wholesale clubs and superstores – Target, Walmart, Sam’s Club, BJ’s Wholesale, and Costco – to see what their 2024 performance and past holiday season visit patterns can tell us about what to expect this Q4.

Wholesalers Outperform Superstores in Q3 2024

Warehouse clubs have been thriving in 2024, buoyed by price-conscious consumers eager to load up on inexpensive essentials. In Q3, quarterly visits to retail giants Sam’s Club and BJ’s Wholesale rose 5.2% and 5.9%, respectively. And Costco, holding its place ahead of the pack, saw a foot traffic increase of 7.2%. For all three chains, the robust visit growth continued into October, with visits up 3.6% to 5.9% YoY.

Meanwhile, Target and Walmart saw respective quarterly YoY foot traffic upticks of 1.0% and 0.9% in Q3 2024. In August – the height of the back-to-school shopping season – visits to both chains increased just over 3.0% YoY. And though foot traffic to the superstore behemoths slowed in September as the summer rush abated, Target saw its visit gap narrow once again in October, while Walmart experienced a slight 0.2% increase.

Historic Holiday Season Visit Spikes

Warehouse retailers have been the clear foot traffic winners this year – but digging deeper into historical data suggests that it is Target that is primed to experience the busiest holiday season of the analyzed chains.

During the week of November 20th, 2023 – the week of Turkey Wednesday and Black Friday – visits to Target soared 18.9% compared to the chain’s 2023 weekly visit average, marking the biggest pre-Thanksgiving visit spike of any of the analyzed chains.

But Target’s real visit surge came during the week of December 18th – the week before Christmas, including the all-important Super Saturday – when visits to Target surged 87.3% above the chain’s 2023 weekly visit average. This was more than double the relative increase experienced by Walmart (39.6%), Sam’s Club (32.8%), BJ’s Wholesale (32.3%), or Costco (34.1%). And with recent visits to Target on par with – or slightly above – last year’s levels, the retail giant is likely poised to win the holidays once again.

Regional Holiday Shopping Patterns

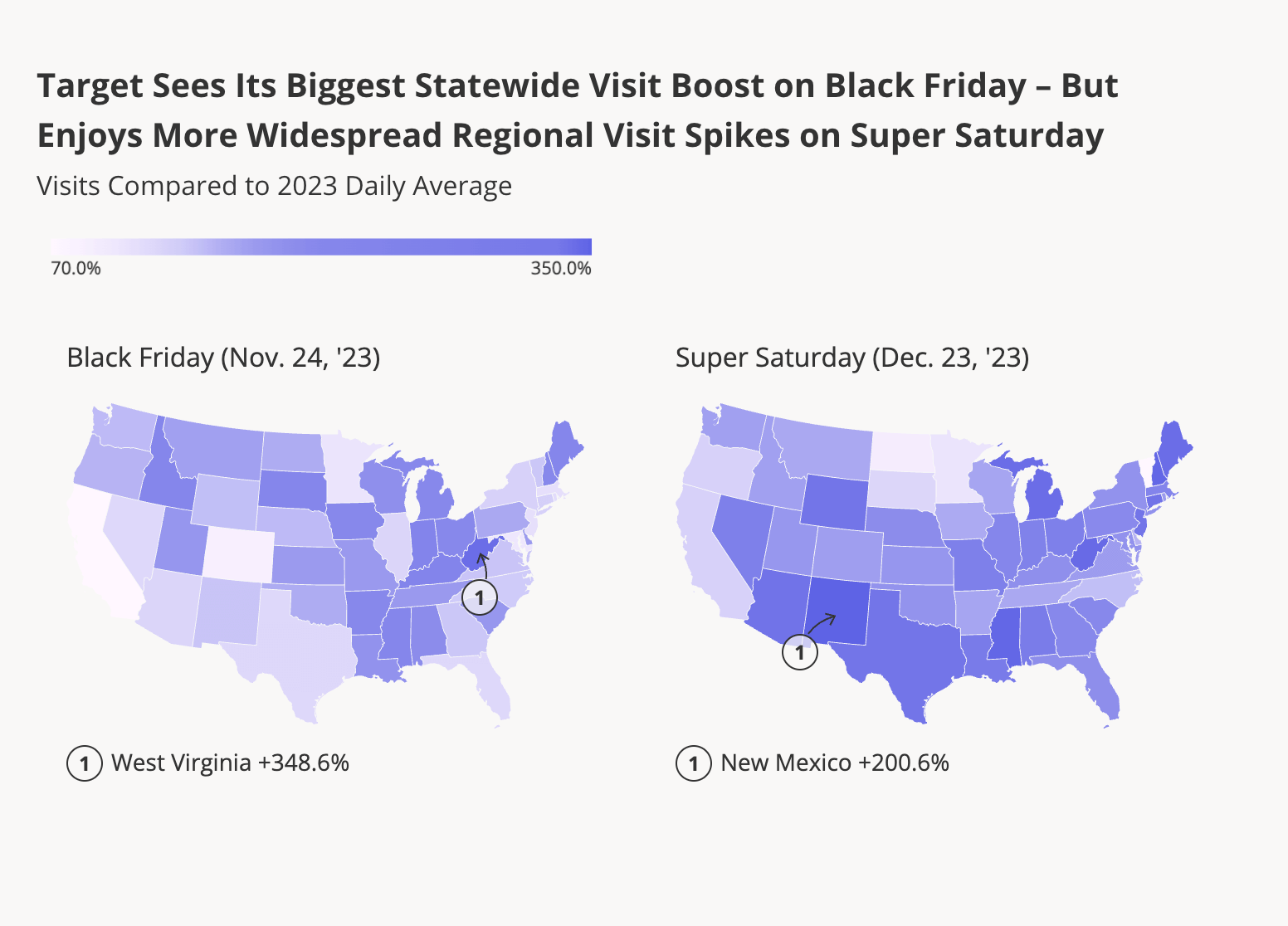

Overall, Super Saturday was a bigger milestone for Target last year than Black Friday. (On the former, visits surged 166.1% compared to a 2023 daily average, while on the latter they rose 135.3%.) But digging deeper into the data reveals significant regional differences in Target’s performance on the two major shopping days.

In some parts of the country – including several midwestern, south central, and nearby states where Black Friday has special resonance – the day after Thanksgiving drew bigger visit spikes than Super Saturday. Some markets in particular saw outsized Black Friday visit surges, including West Virginia (348.6%), Kentucky (232.3%), and Indiana (227.4%). Other markets, such as California (74.6%) and Colorado (89.5%), experienced more moderate – though still substantial – Black Friday jumps.

In contrast, visits to Target on Super Saturday were more evenly distributed across the country, with several western and sunbelt states recording substantial visit increases – including New Mexico, which saw a 200.6% jump in visits to Target on December 23, 2023 compared to the 2023 daily visit average.

Ready, Set, Shop!

With solid Q3s under their belts, Target, Walmart, Costco, Sam’s Club, and BJ’s Wholesale Club are all well-positioned to enjoy a robust holiday season this year. Will the retail giants deliver?

Follow Placer.ai’s data-driven retail analyses to find out.

.png)

.png)

.png)

.png)

.svg)